How to use

Kelly Criterion Calculator is a tool for finding the optimal investment size to maximize profits on repeated investments.

- Winning Probability : Enter the probability of earning a profit from investment.

- Gain of Positive Outcome : Enter the potential gain of a positive outcome. For example, if you invest 100 and get 10, the gain is 10%.

- Loss of Negative Outcome : Enter the potential loss of a negative outcome. For example, if you invest 100 and lose 10, the loss is 10%.

Optimal Investment Size means the ideal investment ratio for the capital. For example, if it is 50%, ideally you should invest 50% of your capital each time. On the other hand, 100% or more means leveraged investments.

What is the Kelly criterion?

The Kelly criterion is a theoretical formula for obtaining the best return when repeatedly investing money. Sizing an investment according to the Kelly criterion can theoretically yield the best results.

Risks

The Kelly criterion requires clearly the probability and magnitude of a return on an investment. However, in real-world investing, it is impossible to fully predict this. In the Kelly criterion, even a small change in probability can significantly change the size of an investment. Therefore, you should not make investments decision based solely on the Kelly criterion.

The usefulness of the Kelly criterion

The Kelly criterion shows that when investing in a more volatile asset, you should scale down your investment size to maximize returns. For example, even if you have the same profit/loss ratio, if you invest in [Win: +20%, Loss: -10%], you need to reduce the amount of investment by half compared to [Win: +10%, Loss: -5%] to achieve optimal results.

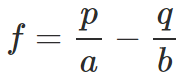

Kelly criterion formula

- f : Optimal Investment Size

- p : Winning Probability

- q : Losing Probability (q = 1-p)

- a : Loss of Negative Outcome

- b : Gain of Positive Outcome