How to use

Compound interest calculator helps estimate compound returns from investments such as stocks or cryptocurrencies.

- Initial amount : Enter the starting amount.

- Number of Calculations : Enter the investment period. Compound interest is applied as many times as the number of periods entered.

- Interest Rate : Enter the expected interest rate per period.

- Calculate : View the results calculated with compound interest.

What is compound interest?

Compound interest is the method of calculating interest where previously earned interest is added to the principal to calculate future interest. Unlike simple interest, which yields the same amount each period, compound interest causes returns to increase over time, making assets grow exponentially.

| # | Asset | Profit | Yield | Total |

|---|---|---|---|---|

| 1 | 10000 | 1000 | 10% | 11000 |

| 2 | 11000 | 1100 | 21% | 12100 |

| 3 | 12100 | 1210 | 33.1% | 13310 |

For example, if the initial capital is 10000 and it grows by 10% each year, the total after three years will be 13310, which is 33.1% higher than the initial capital and 3.1 percentage points more than simple interest.

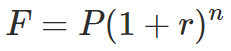

Compound interest formula

When investing with compound interest, the future value of an asset can be calculated as follows.

- F : Future value

- P : Present value

- r : Interest rate

- n : Number of periods

This calculator uses the formula above for its calculations.

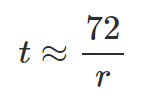

Rule of 72

The Rule of 72 is a quick mental method to estimate how long it takes for an investment to double under compound interest. Divide 72 by the interest rate (in percent) to get the approximate number of years.

For example, at a 5% annual rate, 72 ÷ 5 = 14.4 years, which is close to the exact 14.207 years. While 69.3 is mathematically more accurate (giving rise to the 'rule of 69' or 'rule of 70'), 72 is commonly used because it is divisible by more whole numbers.

Applications

Various types of investments can benefit from compound interest. When investing in savings, stocks, or cryptocurrencies, use this calculator to estimate future returns and help plan your investment strategy.