How to use

Compound Interest Calculator is a tool for calculating the compounding interest return on stock or cryptocurrency investments.

- Initial Investment : Enter initial investment.

- Number of Times : Enter the investing period. The calculation of the compound of interest is repeated as many times as the entered amount.

- Interest Rate : Enter the expected compound interest rate.

- Calculate : Output the compounded results.

What is compound interest?

Compound interest is a way of calculating the interest on an investment by adding together the principal and the interest previously earned. Unlike simple investments, which get the same interest each time, compounding investments grow in value over time. Therefore, assets grow exponentially over time.

| # | Principal | Profit | Yield | Total |

|---|---|---|---|---|

| 1 | 10000 | 1000 | 10% | 11000 |

| 2 | 11000 | 1100 | 21% | 12100 |

| 3 | 12100 | 1210 | 33.1% | 13310 |

For instance, assume a $10000 initial capital and a 10% yearly rise, the interest increases by 10% in the first year but by 11% in the second. Finally, in the third year, the total is $13,310, an increase of 33.1% on the principal. This is 3.1 percentage points higher than assuming simple interest.

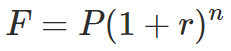

Compound interest formula

When investing with compound interest, the future value of the assets can be calculated in the following ways.

- F : Future value

- P : Present value

- r : Interest rate

- n : Number of compounding periods

The formula for compound interest used in this calculator follows this formula.

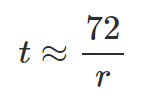

Rule of 72

The Rule of 72 is a mental calculation to determine how long it takes for an asset to double with compounding interest.

The calculation is simple: divide 72 by the compound interest rate. For instance, if the annual interest rate is 5%, it would take approximately 72/5 = 14.4 years for the asset to double. This estimation is very close to the actual period of 14.207 years. The Rule of 72 is helpful in situations where a calculator is not available. Occasionally, the Rule of 69 or the Rule of 70 is used because using 69.3 or 70 is mathematically more accurate than 72. However, the Rule of 72 is more commonly employed as it is more divisible by natural numbers.

Where to Use

Most investments can yield profits through compound interest. When investing in deposits, stocks or cryptocurrency, use the Compound Interest Calculator to calculate potential returns and plan for the future.